This is very basic but I tend to forgot, so this is my glossary of investment stuff to remember 🙂

TL;DR

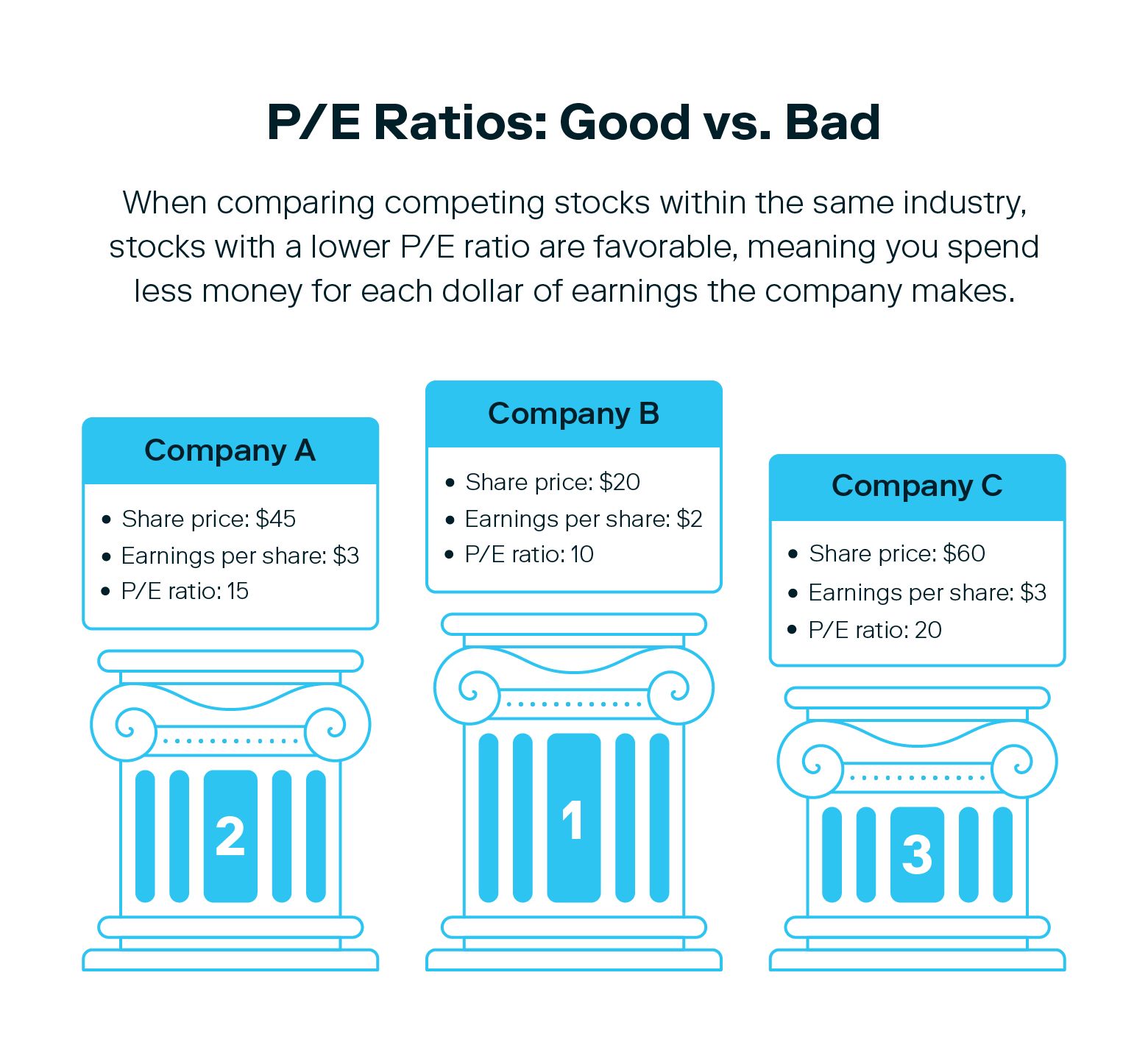

- PER is 20 to 25 (low is better).

- P/S is between 1 and 2 (low is better).

- low debt (<30%) to asset means company can innovate.

Price-to-Earnings ratio (PER)

The ratio is used for valuing companies and to find out whether they are overvalued or undervalued.

| Value | Description |

|---|---|

| N/A | If the company has losses, its PER will be indeterminate. Although a negative PER can be calculated, by convention an indefinite PER is assigned to these companies. |

| 0-10 | Either the stock is undervalued or investors believe the company’s profits are declining. |

| 10-17 | For the vast majority of companies, this PER value is appropriate (i.e., return on investment plus standard profit). |

| 17-25 | Either the stock is overvalued or the company’s profits have grown since the most recent earnings were published. It can also indicate that investors believe profits will grow substantially in the near future (see speculation). |

| 25+ | A PER of this magnitude may be due to high expectations of future profit growth, or the company may be in the context of a speculative financial bubble. Prices are inflated. |

It indicate how much potential investors currently have ot pay for each dollar of Earnings generated by the company.

Price-to-Sales (P/S) ratio

The Price-to-Sales Ratio (P/S Ratio) is a financial metric used to assess the valuation of a company in relation to its total revenues. It is calculated by dividing the market capitalization of a company (the total market value of all its outstanding shares) by its total revenues or sales.

In general, a lower P/S Ratio may suggest that a company is valued more attractively in relation to its revenues, while a higher P/S Ratio may indicate that the company is relatively overvalued compared to its sales.